IRS Automated Collection System (ACS): How It Collects Your Tax Debt

What is ACS?

The Automated Collection System (ACS) is the computer system that the IRS uses for automated tax collection. The ACS can send notices, issue tax liens, and initiate collection actions like wage garnishments and bank seizures. There are also IRS call centers associated with the ACS across the country. If taxpayers receive ACS notices and call the IRS, their calls are routed to an ACS center, but ACS call center employees may also call delinquent taxpayers and perform some limited collection actions.

Not all back taxes are collected by the ACS. The IRS may also assign your case to a Revenue Officer, and that typically happens if you owe over $100,000, have a complex tax case, or have a history of noncompliance.

Key takeaways

- ACS - IRS's Automated Collection System

- Notices - sends CP notices such as CP14, CP501, CP503, and CP504.

- Collection actions - may initiate tax liens, wage garnishments, and bank seizures.

- What to expect - when you call the ACS, your call will be routed to a random employee who has no prior contact with your case.

- Revenue officer escalation - if you don't make arrangements on your tax debt, the IRS may assign your account to a revenue officer for hands-on collection.

What to Expect - Dealing with the IRS’s Automated Collection System

When the IRS assigns your case to ACS, you do not deal with any specific or designated agent. Instead, when you call, you talk with the first available agent, typically after a long hold of 15 to 30 minutes, or maybe even an hour or longer. Once you get an ACS agent on the phone, you may have to explain your case even if you have called many times before. Agents take notes during calls, but each time you call, the new agent has to review the notes to see what's going on with the case, and the notes aren't always thorough.

Once the agent familiarizes themselves with your case, they may be able to answer your questions, help you set up payments, or offer you penalty abatement. However, in other cases, they may not be able to answer your questions or help you understand relief options - unfortunately, ACS employees have the least training of any IRS representatives who deal with the public.

EA Martin Cantu reminds clients that persistence pays off when dealing with ACS: “Tax collection is a process and not an event.”

Unexpected Challenges When Dealing With ACS: Expert Perspectives

While the ACS system is designed to handle collections efficiently, it often leaves taxpayers frustrated due to its rigid structure and inconsistent support. Below, seasoned professionals share real-world challenges—and how they guide clients through them.

Tax Attorney Stephen A. Weisberg describes one of the most frustrating but overlooked issues with the IRS Automated Collection System (ACS): inconsistency.

“One of the biggest surprises for taxpayers is how inconsistent ACS can be. You can talk to one agent in the morning, call back after lunch, and hear something entirely different. Same case. Same facts. Wildly different answers. It’s maddening.”

“Most people don’t realize that ACS agents don’t have access to your entire file. They only see what's in their limited system, and the majority lack the necessary training to analyze complex financials or long-term resolution strategies. So if your case doesn’t fit neatly into a box, they’ll either deny the request or pass you off to someone else who also isn’t equipped to help.”

“That’s where a tax attorney steps in. I don’t let my clients play the IRS version of customer service roulette. I control the conversation, escalate when needed, and put everything in writing. I’ve learned how to box ACS in—how to guide them to the right result, even when they don’t know the rules themselves.”

CPA James Cha highlights how the lack of case continuity in ACS creates both inefficiencies and frustration—and shares how he prepares clients to navigate it:

“One surprising challenge is the lack of continuity and case ownership within ACS. Taxpayers often speak to a different ACS employee with each contact, meaning they must repeatedly explain their entire situation and provide the same background or financial information. This is not only frustrating but can impede progress, as the new agent must get up to speed each time.”

“To help clients navigate this, I emphasize the need for meticulous documentation of every interaction, including the date, time, employee name/ID, and the specifics of the conversation. We prepare a concise summary of the case history and key facts to provide at the start of each call. If an ACS employee is difficult or uncooperative, we follow the practice tip of terminating the call and calling back to reach a different agent. If issues persist, we document the lack of progress and explore options like asking for a manager or potentially requesting a Taxpayer Assistance Order (TAO) via Form 911 if criteria like significant hardship or lack of response are met.”

Judson Mallory of Wiggam Law shares a practical challenge many taxpayers don't anticipate: how long it takes just to get someone on the phone when dealing with ACS—especially during emergencies:

“I find most taxpayers are surprised at how long it takes to connect with a representative when calling ACS. Hold times can be up to 2 hours long, and it is not uncommon for the call to be immediately disconnected. This can be extremely challenging when a taxpayer is faced with a bank account levy, wage garnishment, or filing of a Federal Tax Lien. If your situation is urgent and you cannot get in touch with the IRS, it is incredibly stressful.”

“There are certain times in the day where call times are reduced. When there are urgent issues, we often will prioritize calling in during those time periods in the day where we have a greater chance of connecting with an agent. Alternatively, we will call on multiple clients at the same time to cover as much ground as possible once we have an agent connected on the line.”

ACS Case Resolution Success Stories

The IRS's Automated Collection System (ACS) can seem impersonal and rigid, but persistence and strategy can lead to some of the best outcomes. At TaxCure, we have real success stories of professionals on TaxCure who have navigated the ACS challenges to secure a resolution for their clients by proving that knowing how the system works can make a huge difference for client outcomes.

Judson Mallory of Wiggam Law shared a case where persistence paid off in a big way. The client was under threat of bank levy due to an old tax debt, but Judson suspected the IRS had incorrectly extended the statute of limitations on collections (CSED).

“We raised our dispute with the IRS by submitting our position in writing, and continued to follow up with ACS until the matter was corrected. We kept the client protected from collection enforcement by negotiating collection holds to allow time for the IRS to carefully consider our arguments.”

“We diligently followed up within the time frames they requested, which avoided any levies or asset seizure. The IRS ultimately agreed with our position and wrote off the taxpayer’s remaining liability, saving them over $300,000.”

Tax Attorney Stephen A. Weisberg resolved a time-sensitive case for a small business owner who received an IRS levy due to allegedly unfiled tax returns—returns that had already been submitted.

“The first call to ACS? They told me, ‘We don’t see the returns.’ I faxed them again. Called back the next day—new agent, no clue what I was talking about.”

“So here’s what we did: Re‑submitted the missing returns—with confirmation pages. Requested a temporary collection hold while the documents were ‘under review.’ Called every other day—with written confirmation of what had been sent. Escalated to a manager on day five when we still didn’t have acknowledgment. Manager confirmed returns had been received. Negotiated a monthly payment plan. Levy was released.”

“After ten relentless days of pressure, ACS finally acknowledged receiving the returns and sent them for processing. We then negotiated a manageable payment plan and the levy was released. The only reason it worked was follow‑through. We refused to let it die in the black hole of bureaucracy.”

CPA James Cha helped a client avoid the termination of their installment agreement after a temporary financial setback caused them to miss a payment.

“The first ACS agent they spoke with was rigid, citing policy and stating the agreement would be terminated without immediate full payment or proof of cure. Knowing that ACS employees have limited authority and often follow checklists, we politely ended the call and called back later.”

“After several attempts, we connected with a more empathetic agent. I explained the temporary nature of the financial issue, the client’s prior compliance, and their ability to resume payments quickly. That agent agreed to a temporary hold on collection activity, which gave the client enough time to make the missed payment and avoid default.”

When a Case Moves from ACS to a Revenue Officer

Some cases exceed ACS’s automated authority or involve complexities that require a local Revenue Officer's intervention. Here’s an example of how that transition played out—and why it's often beneficial.

CPA James Cha shares how his client’s case outgrew ACS’s capabilities and had to be escalated to a Revenue Officer for resolution.

“The client initially had a liability just under the typical Revenue Officer threshold, so the case was sent to ACS. They attempted to set up a streamlined installment agreement, but unfiled returns for subsequent periods made that impossible. The total balance quickly exceeded $100,000, and their financials required detailed analysis with Form 433‑B.”

“ACS agents aren’t trained or authorized to conduct in‑depth financial reviews, so the case was transferred to the Collection Field function and assigned to a Revenue Officer. Once assigned, we were able to prepare the appropriate documentation and address the case more effectively through direct, personalized resolution.”

Enrolled Agent Rolanda T. Watson shares a case where persistence and proper documentation got her client transferred from ACS to a Revenue Officer.

“My client was a retired taxpayer with significant equity in their home, but ACS refused to escalate the case despite the size of the balance and the lack of resolution progress. We submitted a detailed financial disclosure packet along with a transfer request.”

“After repeated follow-up and documenting each contact with ACS, we finally received acknowledgment that the case was being transferred to a Revenue Officer. From there, we were able to work on a more realistic payment plan and prevent any enforced collection.”

The ACS Collection Process

If you incur a tax debt by filing a return and not paying or when the IRS adjusts your tax return due to an audit or a non-audit adjustment, your account will be assigned to the ACS. This typically happens a few weeks or months after the tax debt is assessed. At that point, you will receive the following notices. Once they start coming, they will arrive about every six to eight weeks if you don't make arrangements to pay your tax debt:

- CP14 (Initial Notice of Balance Due) - This is the first notice sent when your account is assigned to the ACS.

- CP501 (First Reminder of Taxes Due) - This is a demand for payment.

- CP503 (Second Reminder of Taxes Due) - This is another demand for payment.

- CP504 (Intent to Levy Assets) - The IRS is going to seize your state tax refund and move forward with more collection actions if you don't set up payments.

- CP90 (Final Intent to Levy Notice) - The IRS will seize your assets through wage garnishment or bank levies if you don't set up payments or appeal within 30 days.

As you can see, the first few notices are just reminders that you owe back taxes. If you ignore these notices, nothing drastic will happen, but the IRS will add interest and penalties to your account. However, once you get to CP90, you only have 30 days to take action, and if you don't, the IRS will move forward with garnishing your wages and/or seizing your bank account. Once those actions happen, they're hard to undo - so make payment arrangements as soon as you can. Note that the ACS may send other notices - for exampe, the LT11 about levies.

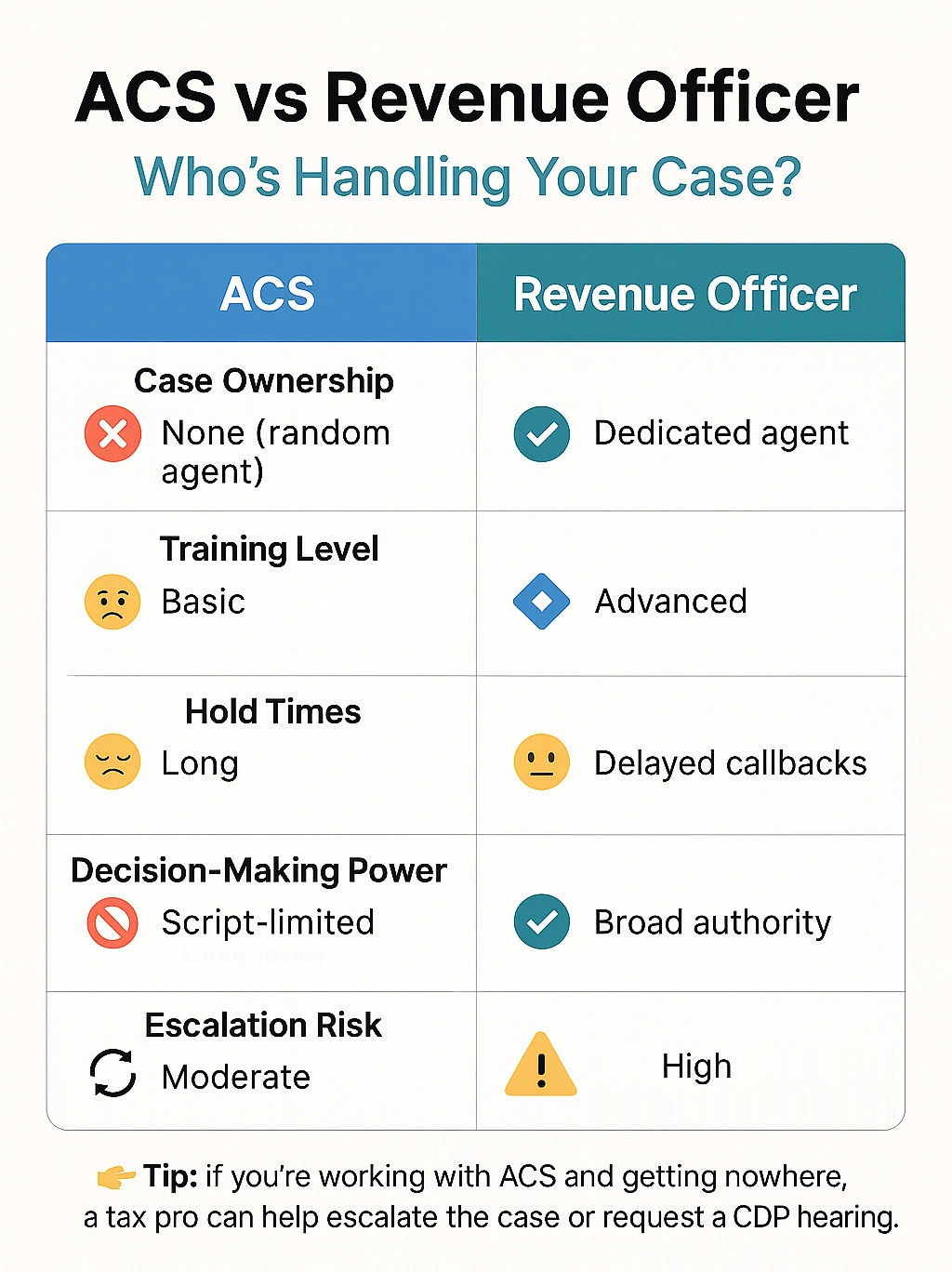

Not sure who's handling your case? Here is a side-by-side comparison of the IRS's Automated Collection System (ACS) vs dealing with an IRS Revenue Officer:

ACS v. Revenue Officer

IRS tax debts are either collected by the ACS or revenue officers, or sometimes, they're transferred to private collection agencies. Enrolled Agent Karen S. Durda notes that engaging with ACS early can often lead to payment plans or penalty abatement—tax solutions that may become more complex once a case escalates to a Revenue Officer.

Sometimes, the IRS transfers accounts from the ACS to a revenue officer - usually because the tax debt is high balance, close to the collection expiration date, involves complex taxes, or is owed by a taxpayer with a history of noncompliance. However, if desired, you can ask to have your ACS case transferred to a revenue officer. The ACS gets to decide whether or not to move your case, but they will consider your request. Here are the main differences between the ACS and working with a revenue officer.

Tax Attorney Stephen A. Weisberg explains that dealing with ACS can feel vastly different from working with a Revenue Officer:

“Think of ACS as a call center with scripts. You’re talking to whoever picks up the phone that day. They generally don’t know the rules; they’re following a script, and they can’t make decisions unless a computer tells them it’s ok. It can be torture.”

“Compare that to having a Revenue Officer—it’s a different world entirely. Your case is assigned a specific person with a manager. They have discretion, they review your case file, and they can actually make decisions. An RO is a real person, someone who knows your file, sees the big picture, and can be held responsible for moving the case forward.”

Judson Mallory of Wiggam Law adds that while ACS lacks case ownership, the ability to reach any available agent can sometimes speed up the resolution process:

“When there is no dedicated agent assigned to the case, it allows for the taxpayer to resolve issues more expeditiously since you do not have to wait for a particular agent to call you back or work on the case. It can provide more immediacy as you can speak with someone the same day you call in, instead of waiting a week or two for a response, which can be a normal response time for busy Revenue Officers.”

- Availability - When you call the ACS, you generally have to deal with a long hold time, but you will always get to talk with a person. In contrast, you can only talk with your revenue officer when they're in the office, so you may end up playing phone tag.

- Meetings - Typically, you will never meet with an ACS employee face-to-face. A revenue officer may request an in-person meeting by sending a 725-B letter.

- Personalized attention -The random employees at the ACS may not understand the unique details of your case. A revenue officer, in contrast, will understand all the nuances of your case. That can help if you're trying to set up payments, but it also means that the revenue officer will be closely looking at your income and assets in case they need to collect the tax involuntarily.

- One person - When you're assigned to a revenue officer, you have to work with that one person, and in most cases, you cannot request a new rep. However, with the ACS, you get to work with whoever answers the phone. There are pros and cons to both of these scenarios.

- Collection processes - Both ACS and revenue officers can file tax liens, garnish wages, and seize bank accounts. However, only a revenue officer can move forward with seizing physical assets.

Enrolled Agent Rolanda T. Watson highlights the critical distinction between these two IRS collection systems, especially regarding case complexity and agent interaction:

“The ACS experience involves working with IRS agents by phone, making it suitable for cases under $100K. Resolution requires the tax professional to stay closely aware of deadlines and notices to act quickly. In contrast, cases assigned to a Revenue Officer involve a dedicated agent, allowing for relationship-building and deeper case negotiation. These cases are typically more complex and require more time and documentation to achieve the best outcome for the taxpayer.”

CPA James Cha further explains how the difference in authority and continuity between ACS and Revenue Officers can significantly impact case outcomes:

“Working with ACS is primarily through a computerized system where personnel handle cases as they appear on screen or through incoming calls. This often means speaking with a different employee each time, requiring repetition of information. ACS personnel have limited discretionary authority and generally follow checklists, often lacking a strong understanding of complex tax code issues.”

“Conversely, dealing with a Revenue Officer (RO) involves a human assigned to your specific case, particularly for higher-dollar or more egregious situations. ROs have broader authority and investigate more deeply, allowing for more detailed discussions and potential negotiation beyond strict checklists, although legal arguments may be less effective with ACS.”

Can you request to have your case be transferred from a revenue officer to the ACS?

No, once your case has been assigned to a revenue officer, you cannot request to have it moved back to the ACS.

Can the ACS revoke my passport for unpaid taxes?

Effectively, yes. Once your tax debt reaches a seriously delinquent level (over $65,000 as of 2025), the ACS can certify your debt to the State Department, and then, the State Department can revoke your current passport or deny your application for a new passport.

What if my case is transferred to a private collection agency?

The IRS will send you a letter if your case is transferred to a collection agency. You can work with the agency to pay in full or set up payments, but you cannot apply for an offer in compromise. If desired, you can request to have your case sent back to the IRS.

How to Get Your Case Into a Different Section of the IRS - CDP Appeals

Federal tax liens and final levy notices explain your right to appeal with a Collection Due Process (CDP) hearing. You only have this right if you receive a notice alerting you about it or in certain other cases, such as if you applied for innocent spouse relief and haven't heard back for over six months. If you request a CDP hearing, that will stop all collection actions until the hearing is completed. Your case will be moved to the IRS Office of Appeals, where you can try to negotiate terms with a Settlement Officer. These people are typically better trained and more knowledgeable than ACS agents overall.

The Scope of ACS - What ACS Can and Cannot Do

ACS can:

- Send computer-generated payment reminders and levy notices

- File a federal tax lien

- Seize your bank account

- Garnish your wages

This information they need to take these actions is usually already in their database. For example, the IRS has your bank and employee records such as W2s and 1099s. Before issuing a levy, ACS must send you a Final Notice of Intent to Levy and Notice of Your Right to a Hearing. You have 30 days to file an appeal, which will have the effect of temporarily stopping the levy.

ACS cannot:

- Seize your house, personal property, or business assets

- File lawsuits

When your account reaches a severe stage, it will be transferred to a local IRS Revenue Officer (RO). At this point, you will no longer be permitted to deal with ACS. If you call ACS and they tell you an IRS collection office took on your case, it’s time to worry. Revenue officers are personally tasked with collecting tax debts, and they can seize your house, personal property, and business assets. If you haven’t done so already, at this point, it’s time to call a tax professional for help.

What to Do to Prevent Collection Actions

If you receive a notice demanding payment from the IRS, take it seriously. Call ACS at the phone number on the letter or call 1-800-829-1040. Be proactive in working out a deal. The IRS offers many options. If you are not sure what to do, our experienced network of tax professionals can guide you through dealing with ACS and the rest of the IRS bureaucracy. Use TaxCure to search for an experienced tax professional today.

- https://www.taxpayeradvocate.irs.gov/tax-terms/automated-collection-system-acs/

- https://www.irs.gov/pub/irs-pia/acs-pia.pdf

- https://www.irs.gov/irm/part5/irm_05-019-006r